CORE partners with business owners and management teams with shared values and high integrity to provide institutional capital for liquidity and generational transitions.

With our flexible capital and committed funds, we can work quickly to structure a transaction that provides full liquidity for retirement. We also partner with sellers seeking to roll over a meaningful portion of their equity and benefit from our experience and Operating Playbook.

We enjoy working with company leadership to understand the challenges your business is facing, share our deep operational experience, and identify the most impactful avenues to create value. Whether that means leveraging our network to source complementary add-on acquisitions, refining your organic growth strategy, or sharing insights developed through our extensive operating experience, we’ll work together to find the partnership that works best for you and your business.

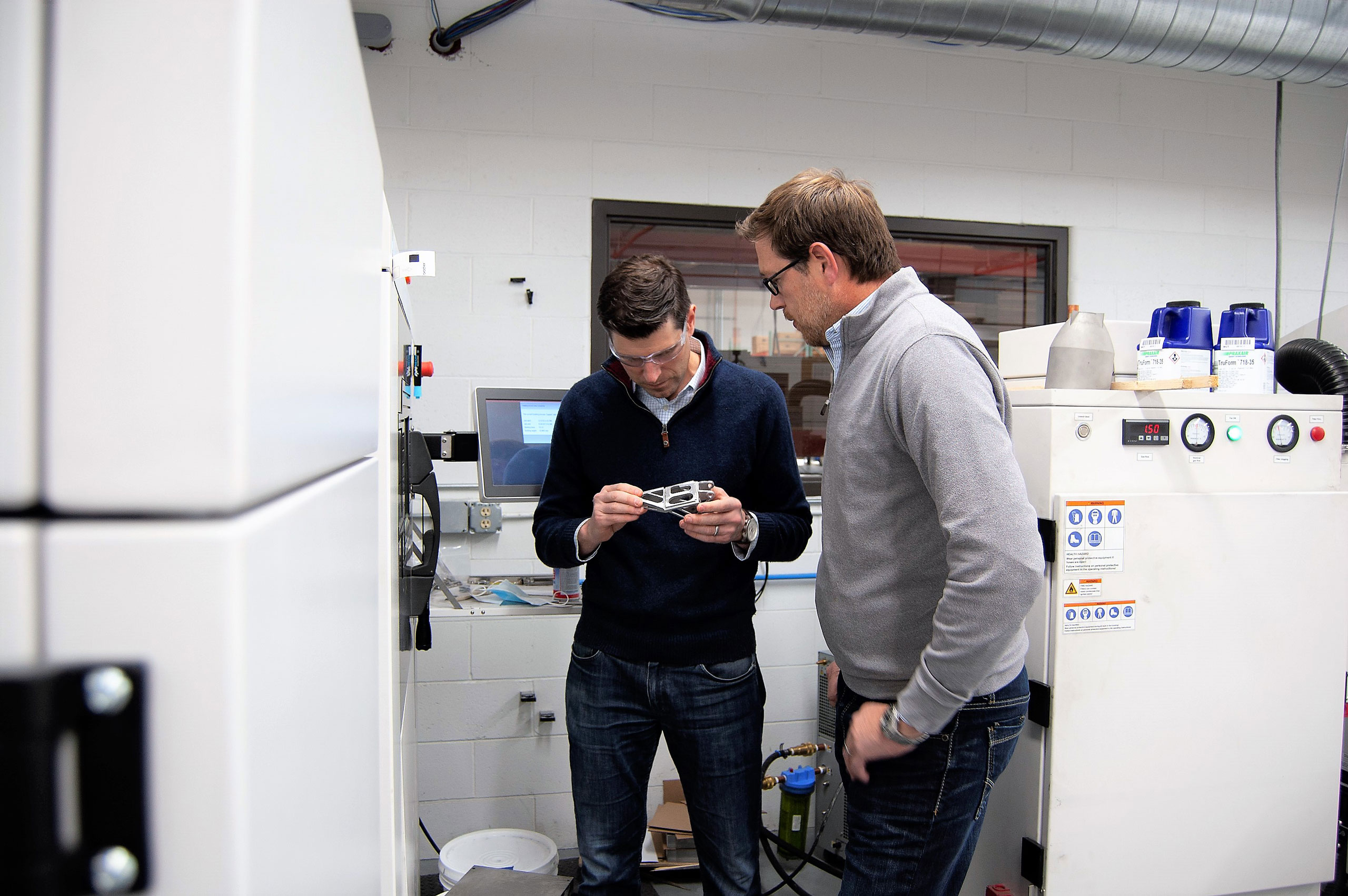

We value the knowledge and experience you bring to the table and work to complement it with the knowledge we’ve obtained from leading and investing in manufacturing and industrial companies. We’re here to support your growth.

We enjoy working with strong leaders, founders, and entrepreneurs to grow businesses. If there are succession issues, CORE can step in as well.

We understand the importance of values and culture. CORE only partners with management teams who have shared values, high integrity, focus, and ambition.

Due to our breadth of leadership experience, we are proud of our ability to work with companies with unique capabilities and compelling customer value propositions.

We are continually seeking to drive organic growth opportunities, invest in fragmented markets, and source add-on acquisitions to build market-leading companies.

From businesses experiencing rapid growth to undermanaged companies with poor financial performance, we have the experience to unlock a company's potential and enhance its performance.

Fuel organic and acquisitive growth opportunities through intelligent deployment of capital

Ability to move and close quickly for the right opportunities using committed capital to fund acquisitions

Although we generally seek majority control, our mandate allows discretion on how much you sell or rollover

We have significant resources and connectivity to identify and acquire complementary add-on acquisitions

Operational experience and resources to increase organic growth and help advance your leadership in the market

Benefit from shared resources across our portfolio companies and our deep industry connections

Up to $200 million

Up to $20 million

Majority Control

North America (international add-ons)

CORE is actively seeking to partner with business owners and management teams who are ready to bring their companies to the next level. We always welcome a conversation and will respond promptly and with the strictest of confidence. We look forward to hearing from you.